ATM cards have become an important part of the banking system across the country. Almost every bank issues an ATM card at the time of opening a new bank account and it can be used at Automated teller machines to withdraw money. Just like any other bank, the State Bank of India (SBI) offers different types of ATM cards for you. These cards can also be used to purchase goods at merchant establishments and for making online payments, apart from cash withdrawal. Here How To Activate State Bank Of India ATM Debit Card Online from its website retail.onlinesbi.com.

According to a video tutorial shared by State Bank Of India (SBI) on its website, you can activate your SBI ATM card online at the bank’s official website – onlinesbi.com. This means that you don’t need to visit the bank branch or ATM to enable the newly-received card. The process can be completed by simply logging in to the State Bank of India (SBI) internet banking portal. All you need is the 16-digit ATM number along with other details to use this facility.

How To Activate State Bank Of India ATM Debit Card Online

Step 1: Visit www.onlinesbi.com

Step 2: Log in to SBI net banking portal by providing the username and password details.

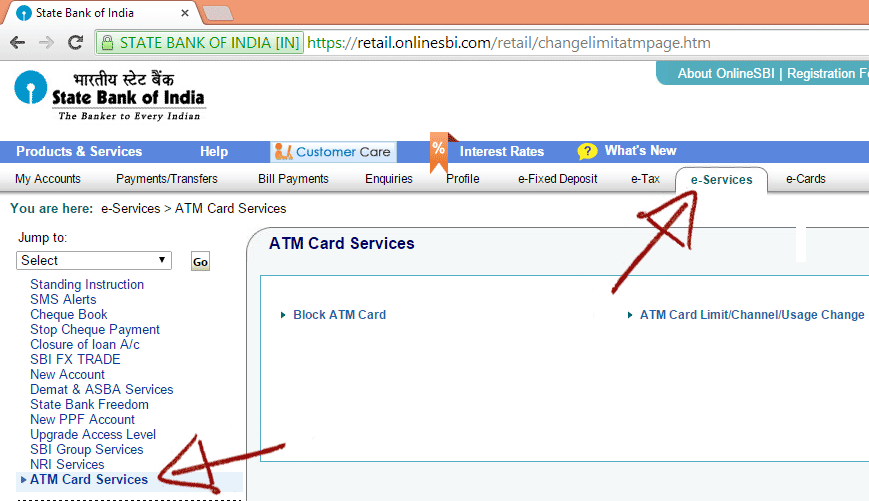

Step 3: Select ‘e-Services and click on the ‘ATM card services‘ option.

Step 4: A new page will appear, click on ‘New ATM Card Activation‘.

Step 5: On the next page, select an account for which you have applied for a new SBI ATM Card. In the given space enter the 16 digit ATM card number.

Step 6: Re-enter the same in the next bar to confirm and click on the ‘Activate‘ option.

Step 7: Verify all the details appears on the new page. Click on the ‘Confirm‘ option.

Step 8: You will receive a high-security password on your registered mobile number. Enter in the high-security password and click on the ‘confirm’ option.

Step 9: A message will appear on the screen that ‘ATM card has been activated successfully!’.

To use your SBI AMT card, you need to generate an ATM PIN. You can create a PIN by visiting any ATM, through SMS or through IVR, or else you can also visit a branch to get an ATM PIN.